What’s your camera’s aperture?

I visit my hometown once or twice a month to stay with my parents and spend time in the mountains, nature, and with my school friends. A few months back when I visited my home town I met my school friends, we had our usual conversations, about what our other school friends were up to, what’s going on in the town, it’s a small town so even if something stupid or irrelevant thing happens we talk about it. I don’t usually remember our conversations, because for one they are not worth remembering and second it’s better not to cloud your head with unnecessary thoughts that may lead to anxiety, as we all have a lot on our plate already.

But this time the conversation struck pretty hard because I have this bad habit (or rather good) of comparing things and finding similarities to the investing world where I spend most of my time, and if I find any similarity I put that in my “lesson learned” section of my brain. So, coming back to the conversation, one of my friends, let’s call him Harsh, wanted to buy a new phone and Harsh is the kinda guy who doesn’t know a lot about tech, I even doubt he knows all the features of the phone he’s using now, he barely uses the phone as a productivity tool, just like a normal user like me, he uses it for general purposes and some entertainment.

A few minutes into the discussion I recommended a phone that would fulfill all his needs with better performance and will last long. One of my tech-savvy friends jumped into the conversation and said,

“I don’t like that model, the camera’s not good, you should choose a phone with a better aperture.”

And with this statement, I and Harsh looked at him like a baby who observes their parents talking to them. From the perspective of a baby, the parent’s words are nothing but noise (sometimes good and sometimes irritating.) Obviously, like babies we had the same reaction in our minds, we asked him,

“What’s aperture?”

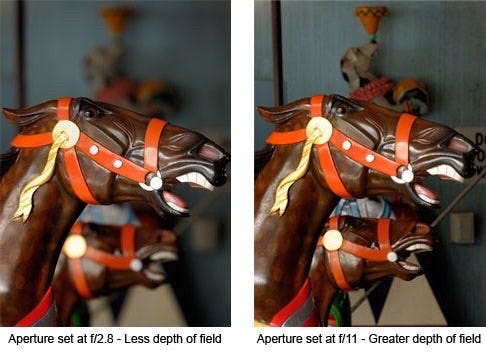

So my tech-savvy friend started explaining in detail, turns out aperture refers to the opening of a lens’s diaphragm through which the light passes (you can see in figure 1).

Aperture is understood in f/stops such as 1.4, 2, 2.8, 4, 8, 11, etc. Lower the f/stop - the larger the opening in the lens - the less the depth of field - the blurrier the background and vice versa, (see figure 2)

Now, not boring you to death, Harsh said,

“Who cares about the aperture? As long as photos look good I’m okay, I am not a professional photographer, although I can tell for myself whether a photo is good or not without going into the details of photography.”

I had similar thoughts too, I never thought about my camera’s aperture and still, I was able to click good photos for myself. I mean as long as the subject or the object in the photo is clear I’m good to go. Long story short, we finally agreed on what model he should buy, I’m not sure whether he bought the model we recommended. I’ll definitely ask the next time I see him.

This incident raised one question for me about investing. As the popularity of investing is spreading like fire, we do see a lot of jargon being thrown around without really knowing what they mean.

“Should anyone not belonging to the investing world care about investing jargon like capex, operating leverage, and P/E to invest and make money in the markets?

One-word answer? a big “No.”

The beauty of equity markets or stock markets is that it doesn’t matter who you are, where you come from, or who you are in a professional capacity, you can participate and create wealth that will help you far out in the future when you’re tired doing the very thing that you’re passionate about. Sure, this long decadal journey of putting your money in the markets without knowing what’s going to happen is scary and an emotional roller coaster, and for a person who’s detached or who doesn’t really know how this complicated world of stock markets work, it can feel like sitting in a train whose destination is unknown.

For an outsider, the stock market journey is similar to the situation Harsh and I were in, we had no idea what aperture meant but that never stopped us from clicking good pictures. Similarly, for an outsider, there is no need to learn complicated finance jargon to create wealth, sure having an idea of how the market works is a great thing but it is not a pre-requisite for investing passively.

I would definitely show some data to back this up, Mutual funds, as they say, is the best way for no-nonsense investing, and are highly recommended for individuals who have very little time outside of their professional career or straight-up don’t like this industry ( I do agree that whatever free time you have should be spent on things you love or with the people who you love especially when something that can be easily delegated like investing.)

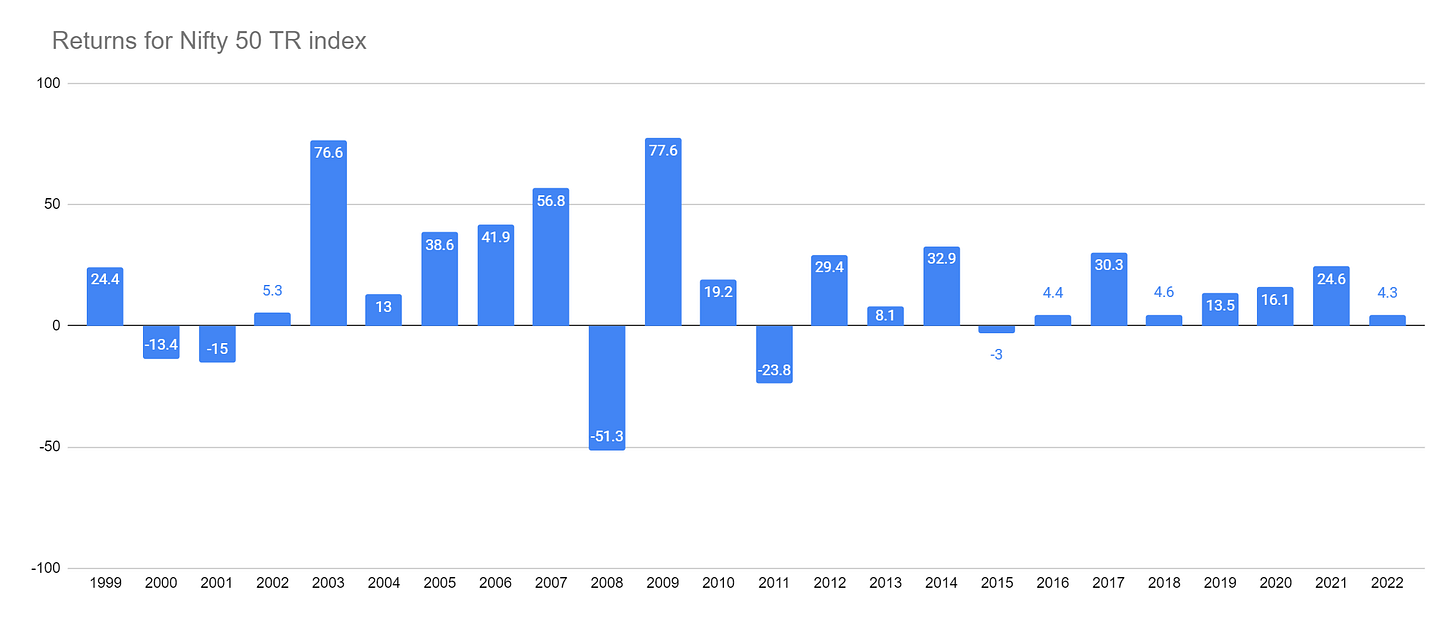

For the sake of simplicity, I am using Nifty 50 as a proxy for the returns generated by the markets.

Here's how a Nifty 50 index has performed for the last 24 years:

If you see Nifty has had only 5 negative years in the last 24 years, which is pretty impressive.

The Nifty 50 index is up 18x in the last 27 years, giving a return of 11.3% CAGR. Comparing this to the Fixed deposit (FD), as it is the most preferred investment product by the Indians, has averaged only 6.36% returns. You would’ve ended up with 3x more money if you had invested in markets over FD.

As an ending note, I only want to stress the importance of investing, we live in a world where the prices of things increase every year (Inflation) but the value of money that you hold in your pocket declines. That’s why we have to shell out more for the same thing that we bought a couple of years back. I would love to write about inflation in another post, but for now, it is smart to think that inflation is an enemy and it slowly kills your spending power and the only way to save yourself is to invest. It doesn’t have to be complicated, a simple mutual fund SIP would be great.

So, if you’re still reading, forget about all the returns and stuff I mentioned, do simple investing, regularly save some money, and invest, even if it is as simple as investing in an Index fund. Your future self would definitely be grateful to you for cultivating this habit.

This is Kaustubh’s Substack.